SharpLink Becomes Largest Public ETH Holder With $463M Acquisition, Pioneers Ethereum Treasury Strategy

SharpLink Gaming, a Nasdaq-listed sports betting technology firm, has made headlines with a bold $463 million purchase of 176,271 Ether (ETH), positioning itself as the largest publicly traded holder of Ethereum globally. The move signals a growing corporate shift toward digital assets, but this time, Ethereum—not Bitcoin—is taking center stage.

In its announcement Friday, SharpLink revealed that the acquisition was funded through a mix of private placements and at-the-market equity sales, with $79 million raised since May 30. The company paid an average of $2,626 per ETH, and over 95% of its holdings are now staked or liquid staked, allowing the firm to earn yield while supporting the Ethereum network’s security.

Calling the move a “landmark moment,” CEO Rob Phythian said the company has adopted ETH as its primary treasury reserve asset, mirroring a strategy popularized by MicroStrategy with Bitcoin—but this time, focused on Ethereum.

“SharpLink’s bold ETH strategy represents a pivotal milestone and innovative approach to the institutional adoption of Ethereum,” added Chairman Joseph Lubin, who is also a co-founder of Ethereum.

Some are misinterpreting SBET’s S-3 filing:

— Joseph Lubin (@ethereumJoseph) June 12, 2025

It registers shares for potential resale by prior investors

The “Shares Owned After the Offering” column is hypothetical, assuming full sale of registered shares.

This is standard post-PIPE procedure in tradfi, not an indication of…

He emphasized that the staking activity not only generates returns but also helps strengthen Ethereum’s core infrastructure.

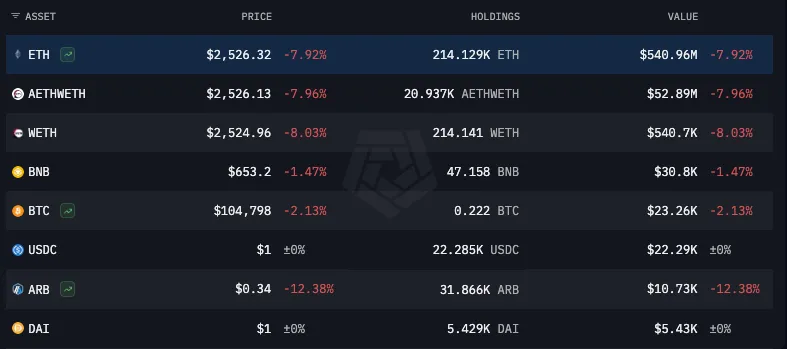

While SharpLink’s holdings outpace those of any other publicly traded company, it still trails some major players in overall ETH ownership. The Ethereum Foundation holds about 214,129 ETH (roughly $594 million), and BlackRock’s iShares Ethereum Trust ETF reportedly holds over 1.7 million ETH, worth around $4.5 billion—though technically on behalf of clients, not for its own treasury.

SharpLink’s aggressive ETH pivot has sparked market excitement—and volatility. Following the initial announcement on May 27, its stock surged over 400%. However, shares plummeted nearly 73% in after-hours trading on June 6, following the release of an S-3 SEC filing. The drop stemmed from confusion over a possible share resale; the filing simply allowed PIPE investors the option to resell shares, not a direct insider sell-off. Lubin later clarified the filing was routine and misunderstood by the market.

The move reflects a broader trend of corporate adoption of crypto as treasury assets, though SharpLink is the first to put Ethereum at the center of its financial strategy. The company says it aims to give shareholders “meaningful economic exposure to ETH”, an approach that may inspire similar moves by other publicly traded firms as confidence in Ethereum’s long-term potential continues to grow.