Quant Network’s QNT Surges 500% in Trading Volume After Overledger Fusion and Quant Flow Reveal

Quant Network (QNT) is making waves in the cryptocurrency market following the launch of two major initiatives—Overledger Fusion and Quant Flow—designed to bridge the gap between institutional finance and decentralized finance (DeFi). The announcements sparked a nearly 13% surge in QNT’s price and a massive 500% spike in trading volume, signaling a renewed bullish sentiment among investors.

New Tech Bridges Traditional Finance with DeFi

At the core of Quant’s latest strategy is Overledger Fusion, a Layer 2.5 network poised to go live in June 2025. The platform introduces a multi-ledger rollup system that enables seamless interoperability between public blockchains while meeting the critical requirements of enterprises, including regulatory compliance, data privacy, and scalability.

Fusion also features a Trusted Node Program, which allows vetted participants to stake QNT tokens and earn rewards based on transaction prioritization. This feature aims to enhance network reliability and incentivize long-term

participation.

Complementing this is the expansion of Quant Flow, the company's programmable payments engine built on PayScript®, a proprietary language developed to automate complex financial tasks. Quant Flow supports both stablecoins and traditional fiat currencies, streamlining operations such as global transfers, treasury workflows, and rule-based payments.

Together, these initiatives represent a significant push to make blockchain infrastructure viable and scalable for institutional-grade financial use.

Technical Indicators Confirm Bullish Breakout

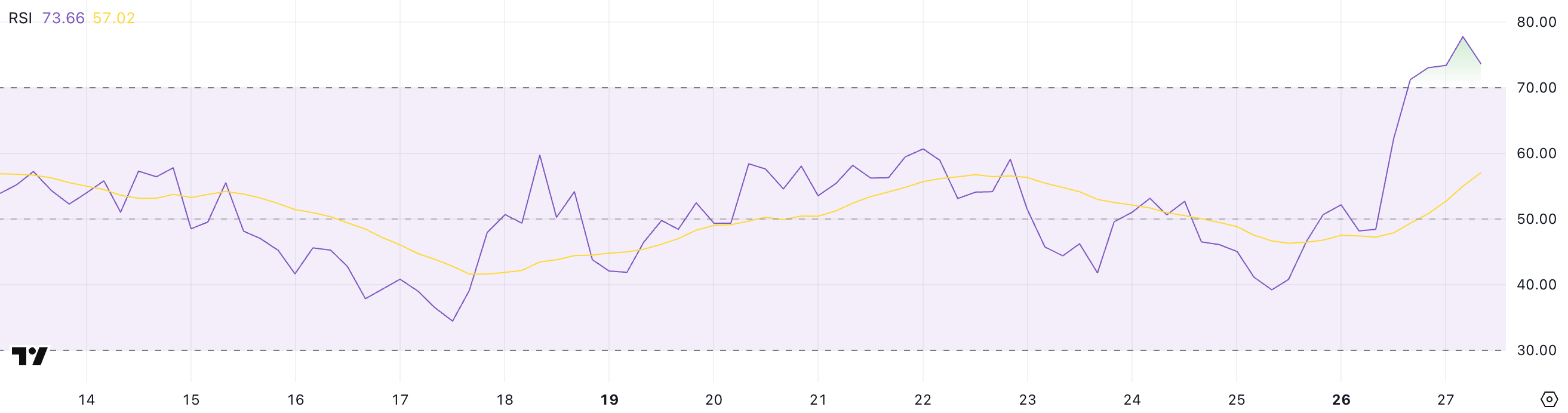

In the wake of these announcements, QNT’s technical outlook has turned sharply positive. The Relative Strength Index (RSI)—a key momentum indicator—jumped to 77.78, signaling strong buying pressure and pushing the token into overbought territory. While such readings often precede short-term corrections, they can also indicate a robust and sustained rally in progress.

Meanwhile, the Ichimoku Cloud chart highlights a clear bullish breakout. The price is trading well above the cloud, with the Tenkan-sen crossing above the Kijun-sen—another bullish signal. The green cloud ahead, along with an elevated Chikou Span, suggests that the uptrend may continue if momentum holds.

Eyes on $115: Can the Rally Hold?

With prices now pushing toward a key resistance level at $111.85, analysts are watching closely to see if QNT can retest the $115 zone—a level last seen in January. Exponential Moving Average (EMA) alignment continues to support the upward trend, but profit-taking or market hesitation could trigger short-term consolidation.

If bullish momentum fades, the first major support lies at $101.22, with further downside potential toward $93.51 or even $89.93 if selling pressure intensifies.