Ethereum Price Stalls Below $2,700 as $4.4B Supply Wall Stifles Uptrend

Ethereum (ETH) is struggling to regain upward momentum as strong selling pressure and a dense resistance zone continue to cap its price under the $2,700 mark. Despite broader market strength—especially Bitcoin’s recent rally to a new all-time high—Ethereum’s performance remains muted, weighed down by profit-taking and shifting investor sentiment.

A Barrier of Billions

At the heart of Ethereum’s current challenge is a significant supply wall: around 1.67 million ETH, worth roughly $4.4 billion, was purchased in the $2,635 to $2,712 price range. This level has become a key resistance zone, with many holders looking to lock in profits, adding considerable selling pressure to the market.

This supply zone not only limits Ethereum’s upside but also discourages new buyers. As a result, even minor upward moves are quickly met with sell-offs, preventing ETH from building sustained momentum.

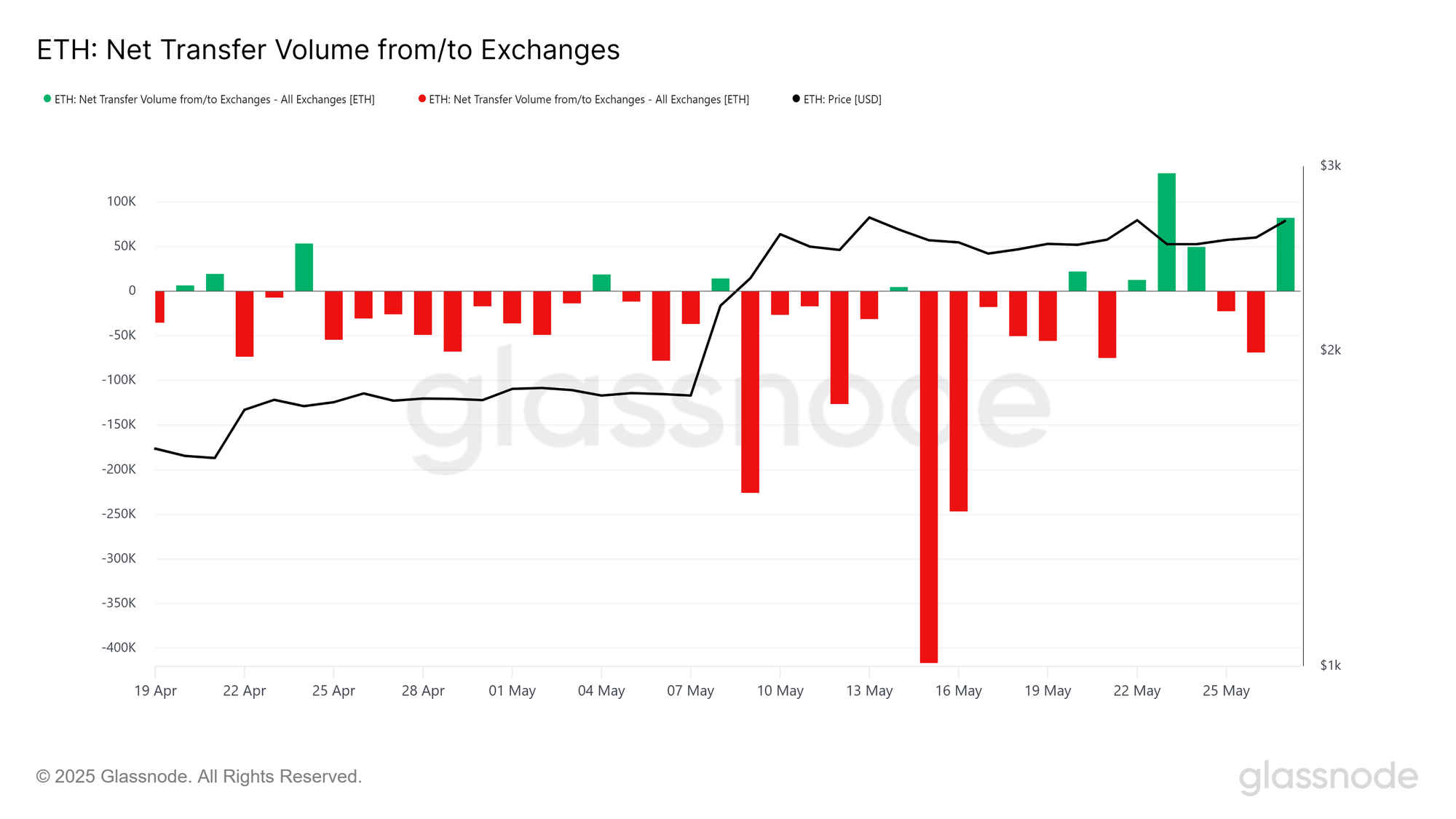

Spike in Exchange Inflows Adds to Pressure

Recent on-chain data reveals a surge in Ethereum being transferred to exchanges—a classic indicator of rising sell-side activity. This shift, marking the first major spike of the month, suggests that investor patience is thinning as ETH continues to underperform relative to Bitcoin.

Currently, Ethereum is trading near $2,641, below the key $2,663 resistance, a level it has tested and failed to break three times in May alone. Meanwhile, the nearest support is holding steady at $2,496, offering a potential base for a future rebound if market sentiment stabilizes.

What’s Next for ETH?

For Ethereum to regain its bullish footing, it must clear the $2,663 resistance convincingly. A successful breakout could pave the way for a move toward $2,814, signaling renewed investor confidence and invalidating the current bearish outlook.

However, as long as selling pressure persists and investor sentiment remains cautious, ETH is likely to stay range-bound. The next few trading sessions will be critical in determining whether Ethereum can shake off the weight of its supply wall or continues to trail behind Bitcoin’s momentum.